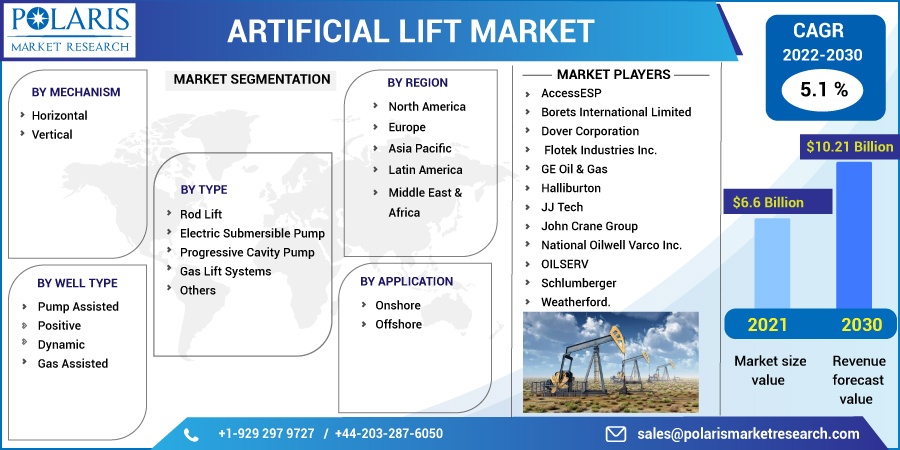

Artificial Lift Market Share, Size, Trends, Industry Analysis Report, By Type (Rod Lift, Electric Submersible, Progressive Cavity, Gas Lift Systems); By Mechanism; By Well Type; By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 101

- Format: PDF

- Report ID: PM2724

- Base Year: 2021

- Historical Data: 2018-2020

Report Summary

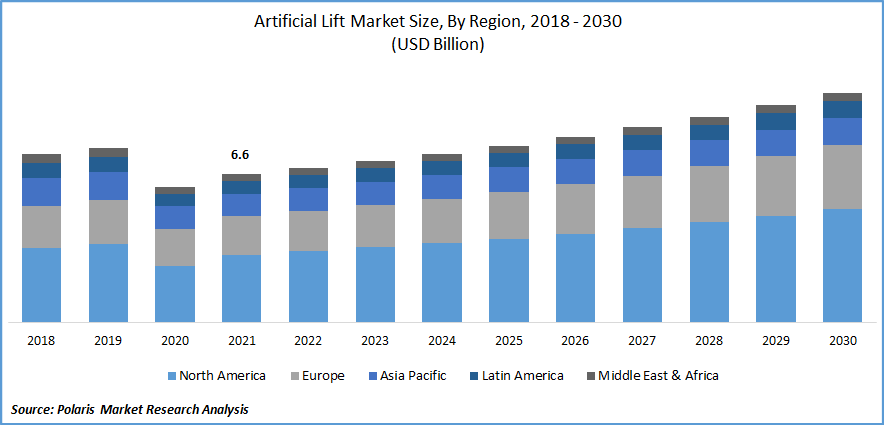

The artificial lift market was valued at USD 6.6 billion in 2021 and is expected to grow at a CAGR of 5.1 % during the forecast period. Rising exploration and production of unconventional oil & gas resources and increasing shale gas production in emerging economies are responsible for the market’s growth.

Know more about this report: Request for sample pages

The artificial lift method lowers the producing bottom hole pressure on the formation to obtain a higher production rate from the well. It can be done by a positive-displacement downhole pump, such as a beam pump or a progressive cavity pump, to lower the flowing pressure at the pump intake.

The reservoir's natural drive energy is insufficient to push the oil to the surface. So, to increase production, mechanical devices or other means are used. Artificial lift methods increase production and recovery by forcing the oil to reach the surface.

Increasing production, growing reservoir pressure, and extending the well's production life are some factors that have driven the good.

Well-integrity issues, such as problems ranging from minor leaks to structural failures, have steadily increased, leading oil and gas key drivers to focus more on safety. So, various new digitization strategies have been adopted to restructure the operations, enabling better analysis of well conditions and reducing operational costs.

The Covid-19 pandemic has hampered the artificial lift market. The effect, such as actions taken by businesses and governments to reduce the spread of the virus, has resulted in a significant decrease in demand for oil and gas. The stringent governmental laws and regulations as well as ordered nationwide lockdowns, have resulted in a decline in transportation and related activities, which reduced the sales and production of the market.

The pandemic led to disruptions upstream of oil and gas operations, such as exploration and production. According to the IEA report, the geopolitical events increased the supply of low-priced oil to the market, and at the same time, the demand declined due to the pandemic outbreak. Additionally, a rapid build-up of oil stocks has saturated the available storage capacity in certain parts of the world, even leading to hostile prices.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The artificial lift market is expected to witness healthy growth during the forecast period due to the rising exploration and production of unconventional oil and gas resources. Various contracts, agreements, investments, and expansions are offering lucrative opportunities for the market players.

For instance, in September 2021, Schlumberger Limited entered into an agreement with AVEVA to integrate Agora edge technologies and cloud-based digital solutions so that the oil operators can optimize their oil and gas production.

The commonly used form of artificial lift for extracting heavy oil is progressive cavity pumps (PCPs), which offer cost-effective production for sandy and viscous oil wells. Several essential oil reserves are present in Canada, Venezuela, Mexico, China, and Colombia, which continuously manufacture heavy oil, driving the market’s growth.

Report Segmentation

The market is primarily segmented based on type, mechanism, well type, application, and region.

|

By Type |

By Mechanism |

By Well Type |

By Application |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Rod lift accounted for the largest market share in 2021

Based on type, the artificial lift market is categorized into rod lift, electric submersible pump, progressive cavity pump, gas lift system, and others, in which rod lift type accounted most significant market share in 2021 owing to its increasing applications in onshore applications.

Rod lift is the standard type of artificial lift method. It uses a pump jack at the surface to work as an artificial lift solution powered by gas or electricity and is also known as a beam pump. For bringing oil & gas to the surface piping and equipment, these pump jacks use sucker rod string and pump, which pressurize the well downhole.

Superior qualities such as high system efficiency, optimized controls, positive displacement, wide flexibility, and others, and as it can be used in wells with a depth of 15,000 ft., have increased sales and production, propelling the segment’s growth.

Gas assisted is expected to grow at the highest rate during the forecast period

Based on the mechanism, the market has been segmented into pump and gas assisted. The gas-assisted segment accounted for the largest market share in 2021. The primary factor attributed to the segment’s growth is less maintenance required for the gas lift than for pump-type lift.

Additionally, these gas lifts are cost-effective compared to pump lifts and are broadly used across several verticals and end-user applications such as mining, oil & gas, and many others.

Moreover, pump assisted is expected to be the fastest-growing segment during the forecast period, including both positive and dynamic displacement pumps, due to the increasing adoption of electric submersible and progressive cavity pumps.

Various technological advancements across these pumps will further positively affect the growth of the pump-assisted mechanism segment.

Horizontal well type account for largest market

The horizontal well type accounts for the largest market share. It is expected to grow fastest during the forecast period due to significant discoveries related to shale gas reserves in the North American region. North American region has discovered a substantial shale gas reserve in the past few years that contribute positively towards the market’s growth in current years, along with high growth predictions over the forecast timeline.

Offshore segment projected to grow at the highest rate during the forecast period

The offshore segment accounts for the largest market share due to increasing upstream activities in the deep-water and ultra-deep-water fields.

Various artificial methods, including electrical submersible pumps, progressing cavity pumps, rod lifts, and others, are commonly used in offshore oil wells. As offshore holds huge unexplored reserves, various companies are looking for offshore areas for oil development.

Moreover, most shallow fields are mainly found in the Gulf of Mexico and the North Sea. The growing number of mature fields in the industry is anticipated to propel the demand for onshore electric submersible pumps. The increasing significance of heavy oil reservoirs and the demand for Electric submersible pump (ESP) systems in shale reservoirs will likely boost corporate growth.

North America is projected to acquire the largest market revenue

North America accounts for the largest market share and is expected to grow fastest during the forecast period owing to the growth in horizontal drilling, especially for unconventional reserves such as tight oil and shale gas. The availability of aged and horizontal wells, and enormous potential across the offshore area, are expected to drive regional market demand.

Moreover, Europe is expected to be the second largest growing region due to the increasing number of mature fields and volatile price changes, creating attractive conditions for company development.

Additionally, the rising need for gas from Eastern Europe has prompted the discovery of hitherto unexplored subsea sources, primarily in the United Kingdom. Concerns about domestic energy security have caused the nations to grant rebuilding licenses to E&P corporations despite the region's rigorous emission standards.

Competitive Insight

Some of the major players operating in the global market include AccessESP, Borets International Limited, Dover Corporation, Flotek Industries Inc., GE Oil & Gas, Halliburton, JJ Tech, John Crane Group, National Oilwell Varco Inc., OILSERV, Schlumberger, and Weatherford.

Recent developments

In January 2022, Unbridled ESP systems introduced high-rise series pumps for minimizing carbon emissions during ESP operations which are used in unconventional well-completion operations.

In November 2021, Halliburton signed an MOU with Cairn Oil & Gas to develop new technologies to help Cairn Oil & Gas achieve its target of increasing recoverable reserve to 300 mmboe from 30 mmboe, which will help Cairn Oil & Gas increase its domestic production of crude oil.

Artificial Lift Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 6.87 billion |

|

Revenue forecast in 2030 |

USD 10.21 billion |

|

CAGR |

5.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Type, By Mechanism, By Well Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

AccessESP, Borets International Limited, Dover Corporation, Flotek Industries Inc., GE Oil & Gas, Halliburton, JJ Tech, John Crane Group, National Oilwell Varco Inc., OILSERV, Schlumberger, Weatherford. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Golf Equipment Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Structural Steel Market Research Report, Size, Share & Forecast by 2017 - 2026

- Carbon Black Market Research Report, Size, Share & Forecast by 2018 - 2026

- Laboratory Filtration Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Content Disarm and Reconstruction Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030