Anti-Drone Market Share, Size, Trends, Industry Analysis Report, By Product (Ground-based C-UAV, Hand-held C-UAV and UAV-based C-UAV); By System (Detection Systems, Detection & Disruption Systems); By End-Use; By Technology; By Region; Segment Forecast, 2022 - 2029

- Published Date:Jan-2022

- Pages: 101

- Format: PDF

- Report ID: PM1026

- Base Year: 2021

- Historical Data: 2017-2020

Report Summary

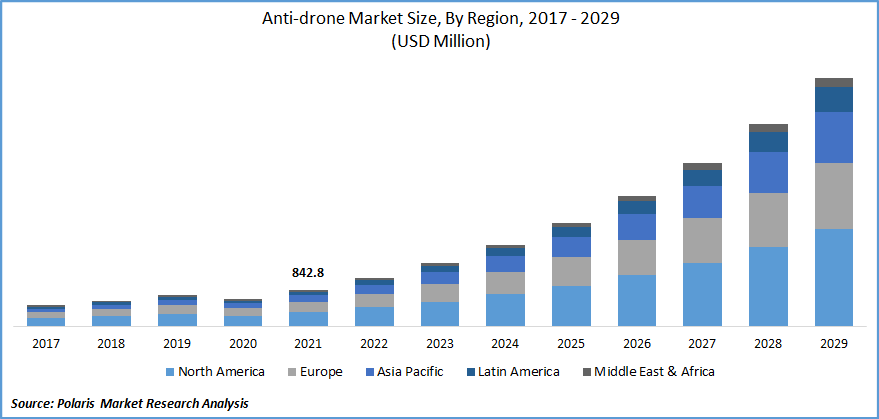

The global anti-drone market was valued at USD 842.82 million in 2021 and is expected to grow at a CAGR of 31.7% during the forecast period. Development in the capabilities of unmanned aerial vehicles technology, adoption of counter UAV across various industries for security, and an increasing number of attacks have led to market demand for security, which is boosting the anti-drone market growth during the forecast period. The developments in the capabilities of UAVs fuel the anti-drone business.

Know more about this report: request for sample pages

Companies that provide anti-drone systems to armies are heavily investing in it by inventing newer methods to fight the threat posed by anti-drone to protect safety and security from terrorists. In terms of technology, the counter UAV sector is expanding. Drone technology advancements and the development of small- and medium anti-drones capable of identifying micro-UAVs ranging from 1.5 to 2 kilometers offer manufacturers opportunities. The growing market demand for devices equipped with radar, RF scanners, and electro-optical infrared for payload detection will drive the anti-drone market.

Civil unmanned aerial vehicles are increasingly being used for agricultural and farming, weather and catastrophe monitoring, oil and gas inspection, aerial photography and filmmaking, scientific research and power, and utility industry surveys around the world. As the use of such systems across numerous industries creates the dangers of hacking by terrorists and anti-social groups, the market demand for counter UAV systems would grow significantly. The rising harmful activities of unmanned aerial vehicles flying close to commercial aircraft and airports create a significant market demand for such systems for safety reasons. The development of such devices that do not interfere with routine airport operations will fuel the expansion of the anti-drone market.

Moreover, an increasing number of security violations by such unlicensed unmanned aerial vehicles along with an increase in terrorism and illicit activities has significantly fueled the anti-drone industry in recent years. Unmanned aerial vehicles are increasingly used for illicit and covert operations such as drug smuggling and spying. Even though numerous prototypes have been produced to oppose one unmanned aerial vehicle at a time, market leaders are working on building superior technological, engineered base solutions to combat simultaneous threats from numerous aircraft systems. However, due to the sheer utilization of laser technology, the cost of R&D activities is relatively expensive. The market's expansion has been stifled as a consequence of this.

Industry Dynamics

Growth Drivers

Rapid usage of anti-drone for professional and recreational purposes, which has raised public and government worries about airborne attacks, the rising government supports, and rising deployment of anti-drone technologies across the globe is fueling the industry. Airborne risks have considerably influenced the design of anti-drone defenses. Several public safety authorities and commercial foundations worldwide are increasingly employing anti-drone technologies to answer the growing requirement for security.

Further, rising government support for the development and marketing of improved drone detection and mapping technologies that provide accurate tracking, increased detection, anti-jamming, and direction-finding capabilities are projected to drive demand for anti-drone systems. For instance, in November 2021, in 2022-23, the Airports Authority of India (AAI) is expected to purchase two such anti-drone systems costing INR 9.9 crore. The counter UAV system provides a comprehensive multi-sensor-based drone detection, monitoring, identification, and neutralization. Also, in June 2021, The Defence Research and Development Organisation's (DRDO) drone technology can provide the armed services an advantage in intercepting, and eliminating enemy drones.

Report Segmentation

The market is primarily segmented based on product, system, end-use, technology, and region.

|

By Product |

By System |

By End-Use |

By Technology |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by System

Detection and disruption systems segment is expected to be the most significant revenue contributor in the global market in 2021 and is expected to retain its dominance in the foreseen period. The rising number of terrorist organizations displaying the capacity to control a wide range of drones, including armed systems, is credited to the growth. For instance, according to the Association of the United States Army, terrorist groups have utilized or attempted to employ airborne drones for various purposes, including intelligence gathering, explosive delivery, and chemical weapon delivery. The FAA (Federal Aviation Administration) permitted the commercial use of drones beyond the pilot's line of sight in 2020. Additionally, detection and disruption systems have significant applications in the military and defense and homeland security verticals. The entry of any unlawful drone into a country's banned territory is recognized, and the drone is subsequently disabled on the spot.

Geographic Overview

In terms of geography, North America had the largest revenue share, in 2021. This is primarily due to the United States Department of Defense's acquisition of counter UAV systems. The US government has made significant investments in the counter-drone effort in recent years. In June 2021, the US Government announced that by FY2022, the Department of Defense (DOD) intends to spend $636 million on counter-UAS (C-UAS) research and development and at least USD 75 million on C-UAS procurement, a USD 134 million boost over FY2021. Thus, the governmental focus on the investment for the development of counter-drone systems is boosting the growth in the region.

Moreover, Asia-Pacific is expected to witness a high CAGR in the global market in 2020. The region is expanding due to rising government spending on aerospace and defense infrastructure development in India and China. In December 2021, the Defence Research and Development Organization (DRDO) had created a counter-drone system for detection, deterrent, and destruction of approaching drones, providing another boost to India's defense system. This drone system will enable the positive effect of drones constituting a danger to national security. DRDO has created a new system to improve overall security.

Competitive Insight

Some of the major players operating in the global anti-drone market include Aaronia AG, Airbus Defence and Space, Battelle, Blighter Surveillance Boeing, CACI International Inc., Chess Dynamics Ltd., Dedrone, Enterprise Control Systems Ltd., Israel Aerospace Industries, L-3 Communications Ltd., Leonardo Spa, Lockheed Martin, Moog Inc., Northrop Grumman, Raytheon Technologies Corp., Saab AB, SRC Inc., Thales Group, among others.

Anti-Drone Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 842.82 million |

|

Revenue forecast in 2029 |

USD 5,779.06 million |

|

CAGR |

31.7% from 2022 - 2029 |

|

Base year |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2029 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2029 |

|

Segments covered |

By Product, By System, By End-Use, By Technology, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Aaronia AG, Airbus Defence and Space, Battelle, Blighter Surveillance Boeing, CACI International Inc., Chess Dynamics Ltd., Dedrone, Enterprise Control Systems Ltd., Israel Aerospace Industries, L-3 Communications Ltd., Leonardo Spa, Lockheed Martin, Moog Inc., Northrop Grumman, Raytheon Technologies Corp., Saab AB, SRC Inc., Thales Group |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Automated Test Equipment Market Research Report, Share and Forecast, 2018 – 2026

- Hormonal Contraceptive Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Smart Home Appliances Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Molded Pulp Packaging Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Mussel Oil Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028