Animal Vaccines Market Share, Size, Trends, Industry Analysis Report, By Product (Attenuated Live Vaccines, Inactivated, Subunit, DNA, Recombinant); By Animal Type; By Region; Segment Forecast, 2021 - 2028

- Published Date:Sep-2021

- Pages: 101

- Format: PDF

- Report ID: PM1971

- Base Year: 2020

- Historical Data: 2016-2019

Report Summary

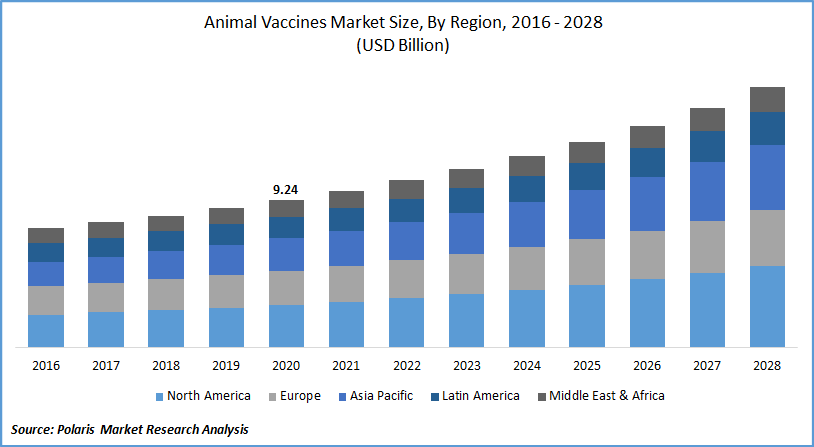

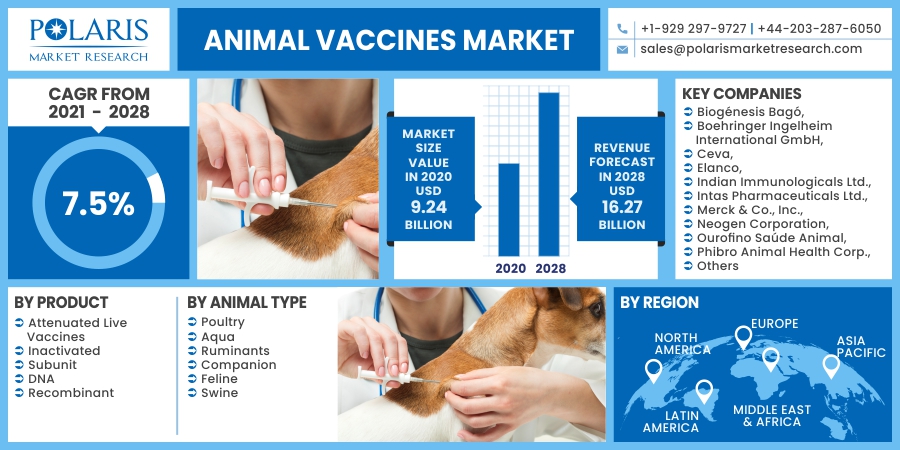

The global animal vaccines market was valued at USD 9.24 billion in 2020 and is expected to grow at a CAGR of 7.5% during the forecast period. The constant introduction of technically sophisticated vaccines, increasing livestock population, and disease outbreaks have led to shifting market dynamics. The market is expected to grow steadily due to the rise in pet ownership in developed countries and the growth in the number of poultry and cattle in emerging economies.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Globally, zoonotic diseases are rapidly increasing, and many believe that novel coronavirus also got transmitted into humans from pets. According to WHO, nearly one billion cases of various diseases occur every year due to zoonosis, and almost 60% of developing infectious diseases globally are from animal sources.

Almost 75% of the more than 30 new pathogens detected in humans in the last 30 years are originated from animals. Since vaccines are the method to prevent infectious diseases in animals that will decrease the chances of human transmission, this will be expected to drive the market's growth.

The emergence of COVID-19 is expected to hinder the growth of the global market since many countries have postponed animal vaccination programs in their countries due to the outbreak of novel coronavirus. However, many countries are developing corona vaccines to vaccinate pets due to the fear of human to the pet transmission of coronavirus.

Recently, Russia registered the vaccine Carnivac-COV, which is expected to be the first vaccine for animals developed against COVID-19. However, overall, COVID-19 is expected to have a negative impact on the animal vaccines market.

Industry Dynamics

Growth Drivers

The global market growth is driven by factors such as the increasing number of zoonotic diseases across the globe in recent decades, along with the growing size of poultry, aquaculture, and pork market that contributes significantly to the economy of many countries. The emergence of new technologies in vaccines and government initiatives to vaccinate pets is expected to propel the market's growth further.

Globally, poultry, aquaculture, and pork industries are significantly contributing to the economy due to the increased consumption of meat. Poultry meat production worldwide was approximately 137 MT in 2020, with China being the biggest consumer of poultry, followed by the U.S, Brazil, Russia, Mexico, India, Japan, Indonesia, Iran, South Africa, Malaysia, and Myanmar.

Aquaculture is also popular in many countries, with 51.3 MT of aquatic creatures produced from inland aquaculture in 2018. China makes two-thirds of total cultivated marine products globally and has the most significant aquaculture industry in the globe. All these factors will cumulatively help in the growth of the global market.

Companies are launching new vaccines and have been involved in acquisition and funding in recent years. For instance, Indian Immunologicals Limited (IIL) launched cell culture technology-based Raksha Class in 2020, a Swine Fever vaccine developed in collaboration with the Indian Veterinary Research Institute (IVRI).

Elanco Animal Health acquired Prevtec Microbial that involved in the development of vaccines to combat bacterial diseases in food in USD 59.9 million deal in August 2019. The acquisition will help Elanco bring Prevtec's R&D programs to Elanco's pipeline and strengthen its swine portfolio.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented on the basis of product, animal type, and region.

|

By Product |

By Animal Type |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Product

The attenuated live vaccines segment generated the highest revenue in 2020. These vaccines can provide better immunity than conventional vaccines by stimulating a broader spectrum of immune responses. Furthermore, it reduces the need for additional vaccines that may be given orally and causes the long-lasting and quick onset of immunity, all of which contribute to the growth of the market for vaccines growing.

The recombinant vaccine segment is anticipated to grow at a high growth rate during the forecast timeframe. These vaccines serve to minimize the risk of pathogenicity after vaccination in the pets. Since recombinants can carry several gene inserts, recombinant vaccines are predicted to aid in the vaccination against multiple viral strains. These vaccine compositions eliminate the need for adjuvants, boost vaccine viability, and increase stability.

Insight by Animal Type

The ruminant vaccines segment dominated the market and generated the highest revenue in 2020. This domination is due to an increase in the number of livestock, favorable government initiatives, and the emergence of diseases in cattle and sheep. Globally, approximately 1,200 PPR outbreaks were detected in 2019. However, there has been a decline in zoonotic diseases, owing to a concerted effort by the FAO and its partners in more than 50 countries, boosting the segment's growth prospects.

The poultry vaccines segment is expected to grow at the highest rate, owing to increased intake of poultry products regularly. The need for poultry products is estimated to increase by almost 20% in the next five years. A broad range of vaccines, pharmaceuticals, and feeds are used to produce higher quality poultry products, expanding the segment's growth potential.

Geographic Overview

North America dominated the market and generated the highest revenue in 2020. The more significant share can be due to the greater frequency of livestock and zoonotic illnesses, which result in large-scale animal mortality.

The existence of many established pharmaceutical companies that are continually working to commercialize their vaccines and expand their global footprint is anticipated to boost the market growth. In addition, in countries like the U.S., animal vaccines are given to food animals and are also being provided to pet animals, driving the region's vaccines market growth.

Asia Pacific is the fastest-growing region for the global market during the forecast period owing to the government initiatives in emerging economies and the presence of large poultry, aquaculture, and pork industry in countries like China. Countries are planning mass immunization programs for food animals. India is also the largest vaccine producer globally, and all these factors will augment the growth of the market in the region.

Competitive Insight

Major players in the animal vaccines market are investing heavily in R&D to develop new advanced vaccines for food animals and pet animals. Companies are also undertaking acquisitions, collaborations, and raising funds to expand their market globally.

Some of the key players operating in the vaccines market include Biogénesis Bagó, Boehringer Ingelheim International GmbH, Ceva, Elanco, Indian Immunologicals Ltd., Intas Pharmaceuticals Ltd., Merck & Co., Inc., Neogen Corporation, Ourofino Saúde Animal, Phibro Animal Health Corporation, Virbac, and Zoetis.

Animal Vaccines Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 9.24 billion |

|

Revenue forecast in 2028 |

USD 16.27 billion |

|

CAGR |

7.5% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Product, By Animal Type, By Region |

|

Regional scope |

North America Europe Asia Pacific Latin America; Middle East & Africa |

|

Key Companies |

Biogénesis Bagó, Boehringer Ingelheim International GmbH, Ceva, Elanco, Indian Immunologicals Ltd., Intas Pharmaceuticals Ltd., Merck & Co., Inc., Neogen Corporation, Ourofino Saúde Animal, Phibro Animal Health Corporation, Virbac, and Zoetis |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Plastic Waste Management Market Share, Size, Trends, & Industry Analysis Report: Segment Forecast, 2018 - 2026

- Rubber Additives Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- UV Curing System Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Cell Banking Outsourcing Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Spices and Seasonings Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030