Aluminum Curtain Wall Market Share, Size, Trends, Industry Analysis Report, By Type (Stick-Built, Unitized, Semi-Unitized); By Application (Residential, Commercial, Infrastructure); By Region; Segment Forecast, 2022 - 2029

- Published Date:Dec-2021

- Pages: 101

- Format: PDF

- Report ID: PM1066

- Base Year: 2021

- Historical Data: 2017 - 2020

Report Summary

The global aluminum curtain wall market was valued at USD 21,420.41 million in 2021 and is expected to grow at a CAGR of 10.2% during the forecast period. A curtain wall is a thin, typically aluminum-framed wall with glass, metal panels, or thin stone infills.

Know more about this report: request for sample pages

The framework is attached to the building structure but does not support the building's floor or roof loads. The demand for the market is increasing due to its benefits, such as good rigidity, lightweight, and high strength. Aluminum curtain wall panels are good corrosion resistance. Furthermore, the growing demand for energy-efficient commercial and public infrastructure solutions has raised market demand.

Aluminum curtains are easy to clean and maintain. Their non-adhesiveness of the fluorine coating film makes it difficult for contaminants to adhere to the surface. The major function of these walls is to keep air and water out of the building, effectively functioning as a buffer and an insulator. Buildings with curtain walls will be easier and less expensive to maintain and will last longer in general because they have an extra layer of protection built-in.

The aluminum curtain wall market was adversely affected by the COVID-19 outbreak due to the declining growth in the construction industry. Due to the nationwide lockdown, goods movement was disrupted, causing construction materials unable to reach the construction site from outside, forcing construction activity to be disrupted.

Industry Dynamics

Growth Drivers

Growing construction activity in developing countries is propelling the demand for the aluminum curtain wall market. The construction industry in the Asia Pacific region offers tremendous prospects in line with substantial infrastructure spending planned across the region. India, Indonesia, China, Australia, Singapore, the Philippines, Thailand, Myanmar, and Vietnam are among the Asia Pacific countries looking to boost infrastructure spending to help their economies recover after the pandemic.

This curtain offers numerous benefits such as securing the structure of the building, reducing the spread of fire, improving the thermal efficiency of a building, and giving a clean, sophisticated appearance. Aluminum is eco-friendly in nature. Therefore, maintaining the long-term sustainability of the building.

The market is gaining traction and is being widely adopted in numerous nations as part of modern infrastructure construction. These curtain walls are being used extensively in business and residential buildings across the globe, from developed to emerging economies. The market for aluminum walls is being propelled by the rapid adoption of energy-efficient infrastructure and the pressing need to reduce carbon emissions.

Report Segmentation

The market is primarily segmented on the basis of type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Type

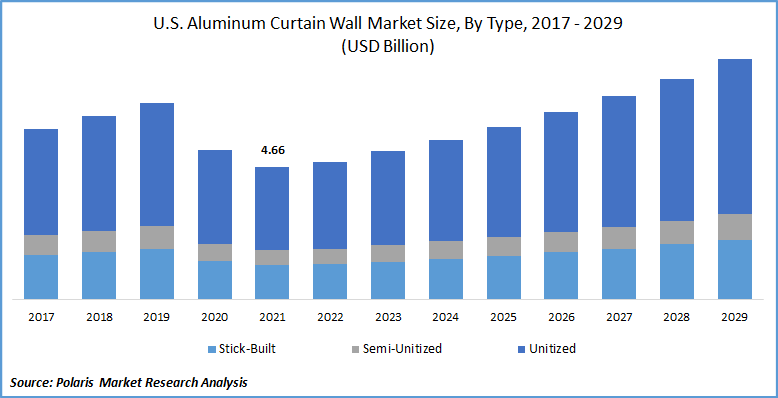

Based on type, the global aluminum curtain wall market is segmented into stick-built, unitized, and semi-unitized. The unitized segment accounted for the largest share in 2020 and is expected to grow at a considerable rate over the forecasted period.

The parts for the unitized segment have already been assembled in the factory. The components are installed and transported to the job site as a single unit from the factory. Individual installation is not required. It offers quick construction and good quality as the components are manufactured in the factory.

The stick-built segment held a significant share in the global aluminum curtain wall industry and is likely to witness significant growth over the forecast period. Components are pieced together on the building's structure in a stick-built segment. This method is primarily employed in low-rise structures or in small areas. This system promises flexibility as it gives space for onsite adjustments.

Insight by Application

Based on application, the global aluminum curtain wall industry is segmented into residential, commercial, and public. In 2020, the commercial segment accounted for the largest market share during the forecast period due to the rising demand for buildings such as hotels, malls, offices, and restaurants. India is one of the world's fastest-growing office space marketplaces due to the rising demand for office rentals, new flexible office spaces, and booming start-ups, and the IT sector, therefore contributing to the growing demand for the product.

The residential segment is projected to register a lucrative growth rate due to the rising demand for improved lifestyle, better residences, rising energy cost, and growing awareness regarding energy-efficient housing.

Geographic Overview

Asia Pacific region accounted for the largest aluminum curtain wall market share over the forecast period. With major infrastructure spending anticipated across the area, the construction industry in the Asia Pacific region provides huge opportunities. India, Indonesia, China, Australia, Singapore, the Philippines, Thailand, Myanmar, and Vietnam are among the APAC countries looking to boost infrastructure spending to help their economies recover after the pandemic.

Given the substantial pipeline of projects and the growing government focus on infrastructure development, the construction industry is projected to offer significant opportunities in the future. Contractors and implementing agencies are using new and advanced technology and digital solutions to accelerate project execution.

Competitive Insight

The key players in the aluminum curtain wall industry include Alumil Aluminum Industry S.A, EFCO Corporation, GUTMANN AG, HansenGroup Ltd., Josef Gartner GmbH, Kalwall Corporation., Kawneer Company, Inc., Purso Oy, Reynaers, RAICO Bautechnik GmbH, Sapa Building Systems Ltd, Schuco International, Skansa, Inc., Trimo d.o.o., Tubelite, Inc., YKK AP.

These organizations are growing their presence across various geographies and entering new markets in developing countries in order to boost their consumer base and strengthen their market presence. In 2019, KUKA formed a strategic partnership with Schuco International. The purpose of this collaboration is to jointly develop and implement automated technologies for the manufacturing of windows, doors, and façades. In 2018, Comar Architectural Aluminum Systems launched an innovative Comar 6EFT curtain wall system. Comar 6EFT provides high-performance solutions for both new build and refurbishment façades.

Aluminum Curtain Wall Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 21,420.41 million |

|

Revenue forecast in 2029 |

USD 44,313.23 million |

|

CAGR |

10.2% from 2021 - 2029 |

|

Base year |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2029 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2029 |

|

Segments covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Alumil Aluminum Industry S.A, EFCO Corporation, GUTMANN AG, HansenGroup Ltd., Josef Gartner GmbH, Kalwall Corporation., Kawneer Company, Inc., Purso Oy, Reynaers, RAICO Bautechnik GmbH, Sapa Building Systems Ltd, Schuco International, Skansa, Inc., Trimo d.o.o., Tubelite, Inc., YKK AP |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Bot Security Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Neovaginal Surgery Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Fire-resistant Coatings Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Patient Referral Management Software Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Nanosatellite and Microsatellite Market Research Report, Share and Forecast, 2018 – 2026