Aircraft Leasing Market Share, Size, Trends, & Industry Analysis Report, By Lease (Dry, Wet); By Aircraft (Narrow Body, Wide Body) By Region, Market Size & Forecast, 2022 - 2029

- Published Date:Dec-2021

- Pages: 101

- Format: PDF

- Report ID: PM1627

- Base Year: 2021

- Historical Data: 2017 - 2020

Report Summary

The global aircraft leasing market size was valued at USD 167.81 billion in 2021 and is expected to grow at a CAGR of 7.8 % during the forecast period. The industry is gaining popularity due to the increasing demand for air travel, rising disposable income, and increasing international tourist travel. The financial burden of obtaining brand new aircraft is so high that almost every airline opts to lease at least some of their planes.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Airlines can use aircraft leasing to decrease their debt, retain cash, and increase their financial agility. Many airline plans include paying a low percentage of the aircraft's value each month. It is the only fleet financing option that allows for dynamic expansion without large capital investments, which numerous airlines have recently taken advantage of.

Airplane leases are regulated by the FAA in the Federal Aviation Regulations (FARs). The FAA classifies airplane leases as either dry leases or wet leases. A wet lease requires an FAA commercial operating license unless there is a special exemption, such as a time-sharing agreement or other possibilities available under FAR 91.501.

COVID-19 outbreak has had a negative impact on the aviation industry across the world. Due to the COVID-19 pandemic, containment measures, and travel restrictions, passengers' behavior has changed, resulting in a significant decrease in market demand for airline services which hindered the growth of the aircraft leasing market. The lockdown was prompted by an increase in COVID-19 cases, which briefly halted operations in the aviation sector including air travel, production, raw material supply, and airplanes delivery.

Market Dynamics

Growth Drivers

The major driving factor of the aircraft leasing market is the rising number of air passengers worldwide. An increase in low-cost carriers and growth in the middle-class population has increased the number of people able to afford air travel, therefore, increasing the market demand for the airplane industry.

Demand for the aircraft leasing market is growing with the increasing advancement in airport infrastructure in developing countries. International Airport Transport Association (IATA) is working with government and airport authorities for the development project across the globe. NEXTT initiative by IATA is working to enhance transport experience, guide industry investments, and help guide governments to improve the regulatory framework. Around US$1.2-1.5 trillion is expected to be spent on global airport infrastructure development up to 2030.

Increasing investment in the aviation sector is augmenting the market growth. To improve airport infrastructure, the Indian government plans to build 100 airports by 2024 (under the UDAN Scheme) and invest $1.83 billion in airport infrastructure development by 2026.

Report Segmentation

|

By Lease |

By Application |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight By Lease

Based on the type of lease, the industry is divided into dry and wet-lease. The wet-lease segment is expected to hold the largest market share over the projected period. Owing to its benefits, such as the owner providing the airplanes as well as at least one crew member in a wet-leasing arrangement. The owner takes on operational tasks, such as providing maintenance, procuring insurance, and other legal obligations.

In a dry lease arrangement, the aircraft owner is providing the aircraft to the lessee without crew. Neither the lessor nor the lessee is required to hold an air carrier certificate, although an air carrier may be a lessor or lessee under a dry lease.

Insight By Aircraft

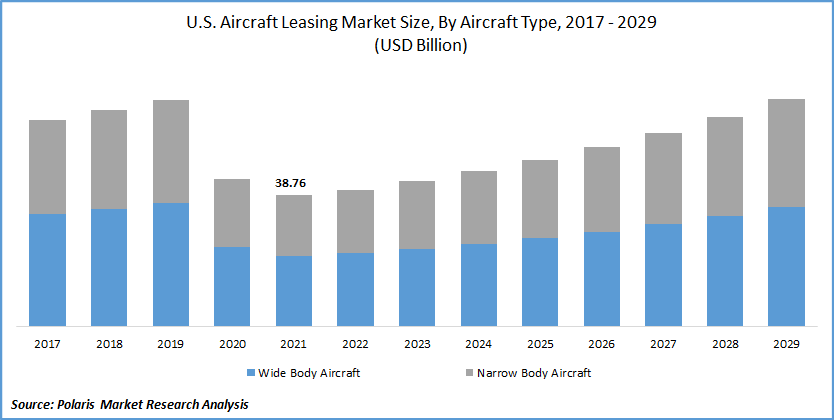

The narrow body segment is expected to hold the highest share over the forecast period due to its low fuel consumption capacity, which leads to cost-saving. A narrow-body airplane gives airlines more flexibility in fleet management and decreases operating costs, both of which contribute to airline sustainability during the pandemic. In recent years, advanced technologies such as new engine alternatives and composite materials have enabled narrow-body airplanes to travel even greater distances with the improved operation and fuel efficiency.

Geographic Overview

Europe dominated the aircraft leasing market on the count of growing air traffic and increasing demand for fuel-efficient airplanes in the region. European airlines are being driven to buy more fuel-efficient planes not only to save money on fuel but also to comply with the EU's Emissions Trading System, a cap-and-trade scheme aimed at reducing greenhouse gas emissions.

Market growth is contributed by the presence of major lease players in the region. AerCap Holdings N.V., Goshwak Aviation Limited, and Nordiac Aviation Capital A/S are the key players operating in the region.

U.S aviation industry is expected to grow at a considerable rate which in turn drives the growth of the market in North America. The rising focus on improving the infrastructure of private airports, combined with positive regulatory reforms, may support the general aviation sector in North America to grow in the coming years.

Competitive Landscape

The leading players in the industry include Avolon Aerospace Leasing Ltd, Air Lease Corporation, Aviation Capital Group, BBAM LLC, BOC Aviation, Boeing Capital Corporation, CIT Aerospace, Inc., BBAM LLC, Dubai Aerospace Enterprise (DAE) Ltd., Flying Leasing Limited, GE Capital Aviation Services, Goshwak Aviation Limited, International Lease Finance Corporation, Nordic Aviation Capital, SAAB Aircraft Leasing, AerCap, Sumitomo Mitsui Finance, and Leasing Co. Ltd.

Leaders in the industry are acquiring top companies, undertaking technological advancements, and adopting expansion strategies to meet the growing needs of customers. In 2021, Nordic Aviation Capital delivered one ATR 72-600, MSN 1251, to Windrose Aviation Company LLC on lease.

Aircraft Leasing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 167.81 billion |

|

Revenue forecast in 2029 |

USD 295.18 billion |

|

CAGR |

7.8% from 2022 - 2029 |

|

Base year |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2029 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2029 |

|

Segments covered |

By Lease, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Avolon Aerospace Leasing Ltd, Air Lease Corporation, Aviation Capital Group, BBAM LLC, BOC Aviation, Boeing Capital Corporation, CIT Aerospace, Inc., BBAM LLC, Dubai Aerospace Enterprise (DAE) Ltd., Flying Leasing Limited, GE Capital Aviation Services, Goshwak Aviation Limited, International Lease Finance Corporation, Nordic Aviation Capital, SAAB Aircraft Leasing, AerCap, Sumitomo Mitsui Finance, and Leasing Co. Ltd. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Carbon Footprint Management Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Mobile Payment Technology Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Drug of Abuse Testing Services Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Cybersecurity Insurance Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Powder Coating Equipment Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030