Air Purifier Market Share, Size, Trends, Industry Analysis Report by Type [High Efficiency Particulate Air (HEPA), Activated Carbon, Ionic Filters]; By Application [Commercial, Residential, Industrial]; By Residential End-Use; By Region, Segment Forecast, 2021 - 2029

- Published Date:Nov-2021

- Pages: 101

- Format: PDF

- Report ID: PM1746

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Summary

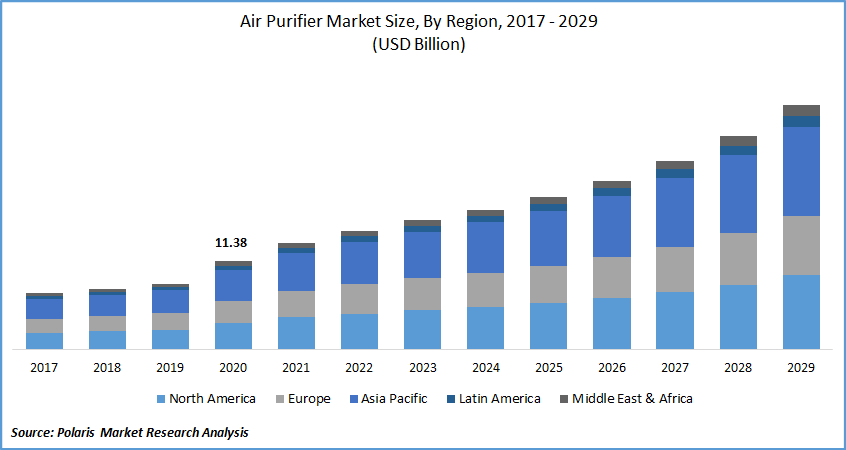

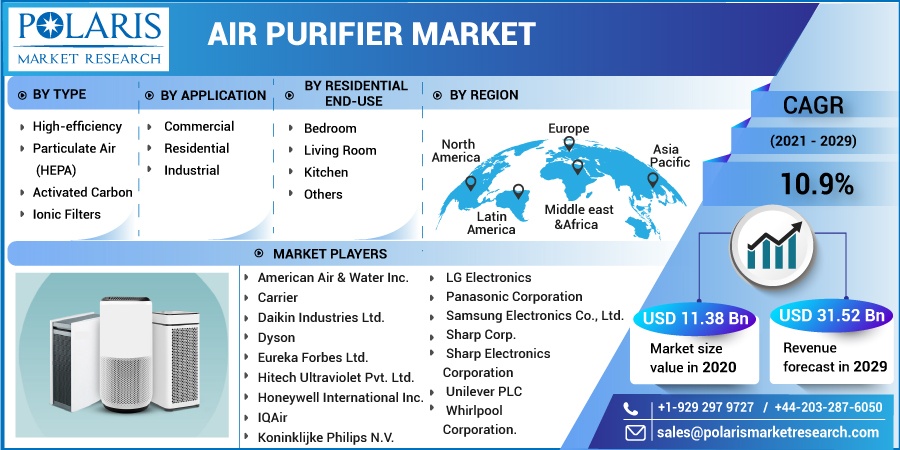

The global air purifier market size was valued at USD 11.38 billion in 2020 and is expected to grow at a CAGR of 10.9% during the forecast period. Growing infections and increasing pollution concentrations in metropolitan centers are projected to boost the purifier market. Increasing government laws for worker occupational health and safety, as well as the need for a clean environment in the medicinal, food, and beverage sectors, will support air purifier market growth.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The COVID-19 outbreak has introduced significant market opportunities to purifier industry participants. Manufacturers are ramping their production and product portfolio as they anticipate rising demand from a wide variety of sectors such as hotels, hospitals, residences, commercial spaces, among others. The pandemic outbreak has resulted in the air purifier being attributed the “Must-have appliance” tag, thus marking a significant shift from the luxury item category.

To stem the transmission of COVID-19, governments throughout the world have enacted lockdown precautions. As a result, stay-at-home and WFH policies have increased growth in the air purifier market. Moreover, there is a high demand for filtration systems from hospitals, colleges, and government organizations, as customers look for solutions to prevent coronavirus spread.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Air purifiers will see greater demand from the industrial sector due to their capacity to provide a sterile atmosphere for worker protection throughout the production process. Storage facilities, factories, and industrial facilities emit abrasive fine dust particles, endangering employees' safety and the health of those who live nearby, making air purifiers popular in the construction business.

Because of modernization, the number of automobiles on the roads has more than doubled, emitting a substantial amount of hazardous pollutants. Older household equipment, such as coolers and freezers, are large CFC emitters.

Consumers are becoming more alert and careful regarding their wellness and indoor pollutants due to the COVID -19 outbreak. The emergence of new quality purifiers that would provide anti-viral and anti-bacterial filtration has increased their demand. These are a few of the primary reasons propelling the purifier market growth.

Air Purifier Market Report Scope

The market is primarily segmented on the basis of type, application, residential end-use, and region.

|

By Type |

By Application |

By Residential End-Use |

By Region Type |

|

|

|

|

Know more about this report: request for sample pages

Insight by Type

HEPA emerged as the largest purifier technology market segment in the year 2021. This is a type of mechanical filter. The operation of this filter is by allowing forced air to pass through a fine-mesh capable of capturing harmful particles, including smoke, tobacco, dust mites, pet dander, and pollens. These are mainly used in portable filters suitable for small areas of operation or household purposes. The key advantage of using this type of product is that this can be used against various allergies ranging from pollen and dust mites, among others.

Insight by Application

With the most significant market position, the commercial sector commands the purifier industry. Air purifiers are employed in a variety of commercial settings, including hotels, educational institutions, healthcare facilities, workplaces, shopping malls, movie theatres, and so on. Air purifiers featuring HEPA and charcoal filters technologies are utilized in restaurants and hotels due to various their efficacy in eliminating contaminants, smell, and smoke, leading to better air quality.

Geographic Overview

Strong demand from the U.S. is driving the North American regional purifier market growth. The market for the U.S. is expected to reach USD 8.01 billion by 2029. The presence of major industry players, support extended by government agencies, and high awareness benefit the regional market growth. In addition, easy availability of products, broad product portfolio, and competitive marketing strategies adopted by market participants are also pushing the North American market growth.

Asia Pacific is expected to grow at a considerable pace over the forecast period due to several causes, including expanding urbanization and industrialization, as well as a bigger population with more disposable money. Furthermore, growing smog and polluted air incidents, particularly in China and India, are predicted to promote the usage of air purifiers, supporting regional market expansion. For instance, the Make-in-India air purification label 'Air OK' was launched in September 2020. This firm introduced an innovation for clean air called "EGAPA Comprehensive." Air OK is the first indigenous purifier firm with its R&D facility in India, as well as all production is also handled in India, in accordance with the Make in India program.

Competitive Landscape

Air purifier manufacturers are aware of the regulations imposed in various countries and manufacture purifiers that meet the prescribed rules. Indoor purification manufacturers design products that meet EPA, OSHA, EURO, and other regulations in order to adapt to the regulatory scenario pertaining to indoor pollution control in the region. Major players operating in the global market include American Air & Water Inc., Carrier, Daikin Industries Ltd., Dyson, Eureka Forbes Ltd., Hitech Ultraviolet Pvt. Ltd., Honeywell International Inc., IQAir, Koninklijke Philips N.V., LG Electronics, Panasonic Corporation, Samsung Electronics Co., Ltd., Sharp Corp., Sharp Electronics Corporation, Unilever PLC, and Whirlpool Corporation.

These players' primary techniques to increase their dominance and achieve a more significant market proportion are new product releases, licensing deals, supply chain growth, technology investments, and acquisitions and mergers. For instance, Panasonic Corporation introduced a new line of ACs fitted with NanoeTM Technologies in January 2021, which produces hydroxyl radicals effective of suppressing numerous germs and viruses, notably SARS-CoV2, to the extent of 99.99 percent.

Air Purifier Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 11.38 billion |

|

Revenue forecast in 2029 |

USD 31.52 billion |

|

CAGR |

10.9% from 2021 - 2029 |

|

Base year |

2020 |

|

Historical data |

2017 - 2019 |

|

Forecast period |

2021 - 2029 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2029 |

|

Segments covered |

By Type, By Application, By Residential End-Use, and, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

American Air & Water Inc., Carrier, Daikin Industries Ltd., Dyson, Eureka Forbes Ltd., Hitech Ultraviolet Pvt. Ltd., Honeywell International Inc., IQAir, Koninklijke Philips N.V., LG Electronics, Panasonic Corporation, Samsung Electronics Co., Ltd., Sharp Corp., Sharp Electronics Corporation, Unilever PLC, and Whirlpool Corporation. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Revenue Cycle Management Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Acetone Market Share, Size, Trends, Industry Analysis Report, 2020-2026

- Pea Protein Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Smart Home Automation Market Research Report, Share and Forecast, 2017 – 2026

- Patient Monitoring Devices Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030