Aerospace Valves Market Share, Size, Trends, Industry Analysis Report, By Material (Stainless Steel, Titanium, Aluminum, Others); By Aircraft; By Application; By Product; By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 101

- Format: PDF

- Report ID: PM2088

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Summary

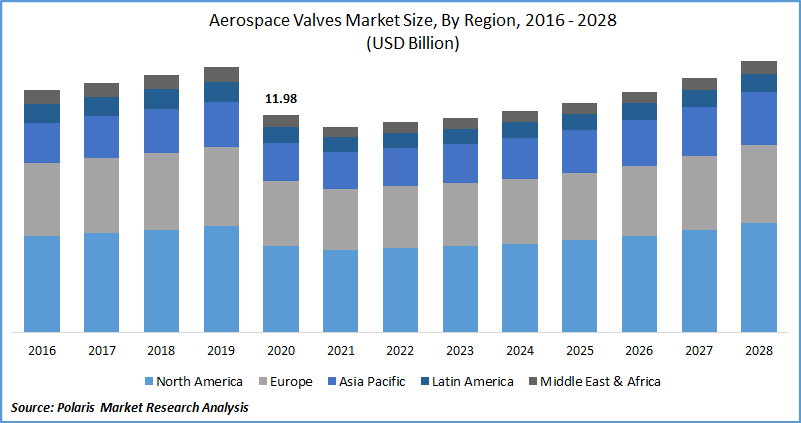

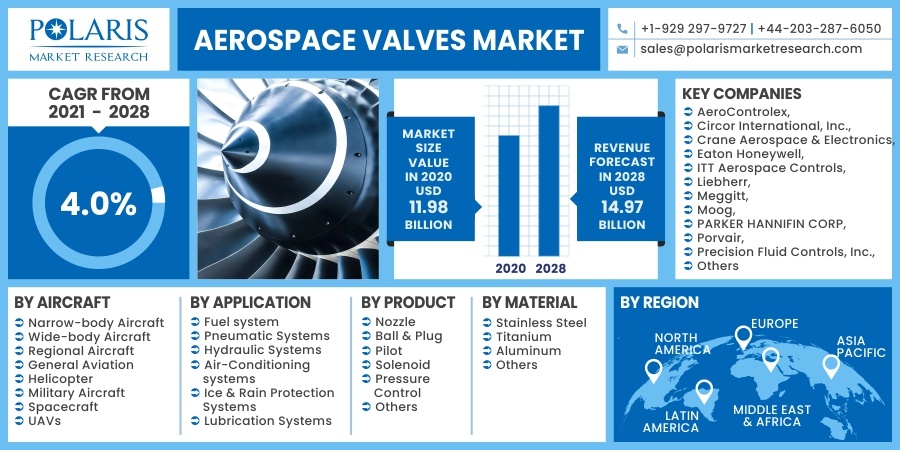

The global aerospace valves market was valued at USD 11.98 billion in 2020 and is expected to grow at a CAGR of 4.0% during the forecast period. Aerospace valves are part of the motion and flow control technologies and perform various integral functioning of aircraft operations such as heat management, controlling oil and fuel directional flow, enabling anti-icing, maintaining pressure control, and optimizing temperature limits.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Valves used in the aerospace industry are being developed with advancements. There is a trend of using electronically controlled aerospace valves to control the flow of gas or liquid and mechanical motions reliably and efficiently across various locations of aircraft. COVID-19 pandemic has caused severe damage to the aerospace market, which is proven to be deepest ever in history compared to previous downturns such as SARS (2003) and the Great Recession (2008).

Based on IATA’s April 2021 estimates, the airline market will incur net losses of USD 47.7 billion in 2021. However, this is an improvement from the losses suffered by the market in the year 2020, which was an estimated USD 126.4 billion. However, the gradual increase in air traffic across the world in response to the opening of lockdown restrictions and heavy vaccination drives indicates a bright aerospace valves market outlook in the coming years, ensuring a strong bounce-back for the market, including its component markets.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Increasing global commercial aircraft fleet size due to rising air passenger traffic is giving an impetus to the replacement demand for aerospace valves, especially from maintenance, repair, and overhaul companies. Aerospace valves are highly exposed to wear and tear during continuous flight operations and are generally replaced rather than being repaired. Leading commercial aircraft OEM Airbus is aiming to increase its monthly production rate to 45 by the end of 2021.

It is further targeting to increase it to 64 per month and 70 per month by 2023 and 2024, respectively. Investments in R&D and ever-increasing advancements in the market have led to the emergence of UAVs (Unmanned Aerial Vehicles) and more electric aircraft. Additionally, there is also a significant market opportunity to integrate Internet of Things (IOTs) among aerospace valves to improve performance, enhance reliability, smooth functioning, and significantly reduce lifecycle costs. Proactive failure detection and predictive maintenance records with IOTs helps in proper and timely valves, enabling better discrete functioning with effective data-based decision-making.

Report Segmentation

The market is segmented in the most comprehensive way based on aircraft, application, product, material, and region.

|

By Aircraft |

By Application |

By Product |

By Material |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Aircraft

Narrow-body aircraft remain the most dominant segment of the overall aerospace valves market primarily driven by re-coupe of domestic air traffic across the globe; however, international air traffic remains at a standstill in the near term with a continued halt of international commercial flights. Furthermore, approval of the long-awaited best-selling aircraft program of Boeing B737 Max by FAA leading to a ramp up in production rates and an increase in pent up demand fueling the narrow-body segment at an impressive rate.

UAVs segment is witnessing the fastest growth in the aerospace valves market, supported by a significant increase in geospatial and security defense spending. Based on the 2021 department of defense budget report of AUVSI (Association for Unmanned Vehicle Systems International), the U.S. DOD (Department of Defense) released a whooping budget of USD 75 billion for un-manned system technologies ensuring exponential growth in UAVs ultimately driving the demand for components including aerospace valves in the market.

Insight by Application

Among applications, the hydraulic systems segment accounts for the largest share of the global market. There is an increasing demand for lightweight and efficient hydraulic systems supported by technically advanced valves. A rise in power and efficiency of an aircraft also has generated a growing need for regulating desired hydraulic pressure. It prevents failure of components under excessive pressure being generated via valves integration into systems.

Furthermore, a rise in temperature and pressure environments also drives the demand for efficient aerospace valves in the market. Valves play an important role in allowing feeding fuel to the main engine and shut off in the event of an emergency or unwanted migrations. Significant growth in aerial refueling generated the need for more and more tanker aircraft is also driving the demand for re-fuel or de-fuel aerospace valves at a healthy rate.

Insight by Product

Pressure control valves hold high dominance in the global market. They are driven by their versatility in usage across different application areas, including hydraulic systems, fuel systems, pneumatic systems, engines, and air-conditioning systems. There is an increasing level of pressure onboard and on the engine and mechanical systems of an aircraft with an elevation of power and efficiency needs fueling the demand for pressure valves. Solenoid valves are attributed to offering impressive growth in the market during the forecast period.

The aircraft industry has a growing need for high temperature resistant and electronically intelligent components to support modern technological advancements across systems, leading to the increasing demand for solenoid valves in the industry. Lightweight and rugged solenoid valves have been gaining share in the market across multitude of applications among both military and civil aviation.

Geographic Overview

Geographically, North America remains the vanguard of the market, with its leading position to be retained during the forecast period. The region is backed by strong industry intelligence, making it a hub of the aircraft industry from component manufacturing to aircraft assembly to defense and security leadership. There is also a growing need for lightweight and high-performance aerospace valves in the region to support the demand from modern aircraft platforms such as B777x, A220, and B737Max.

Asia Pacific to depict highest CAGR in the global market during the forecast period supported by region’s growing interest in indigenous manufacturing of components and systems, low cost of labor attractive aircraft industry stakeholders from developed economies, and largest fleet size of commercial aircraft ensuring substantial market demand.

Competitive Landscape

Some of the key players competing in the global market are AeroControlex, Circor International, Inc., Crane Aerospace & Electronics, Eaton Honeywell, ITT Aerospace Controls, Liebherr, Meggitt, Moog, PARKER HANNIFIN CORP, Porvair, Precision Fluid Controls, Inc., Safran SA, Sitec Aerospace GmbH, Triumph Group., United Technologies Corporation, and Woodward, Inc.

Aerospace Valves Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 11.98 billion |

|

Revenue forecast in 2028 |

USD 14.97 billion |

|

CAGR |

4.0% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Aircraft, By Application, By Product, By Material, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

AeroControlex, Circor International, Inc., Crane Aerospace & Electronics, Eaton Honeywell, ITT Aerospace Controls, Liebherr, Meggitt, Moog, PARKER HANNIFIN CORP, Porvair, Precision Fluid Controls, Inc., Safran SA, Sitec Aerospace GmbH, Triumph Group., United Technologies Corporation, and Woodward, Inc. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Volumetric Display Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Drinking Water Adsorbents Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Downstream Processing Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Autonomous Truck Market Share, Size, Trends, Industry Analysis Report, 2020-2027

- Rapid Medical Diagnostic Kits Market Share, Size, Trends, Industry Analysis Report, 2020-2027