Aerospace Parts Manufacturing Market Share, Size, Trends, Industry Analysis Report, By Product (Aerostructure, Cabin Interiors, Engines, Equipment, System, and Support, Avionics, Insulation Components), By End-Use, By Region; Segment Forecast, 2022 - 2030

- Published Date:Mar-2022

- Pages: 101

- Format: PDF

- Report ID: PM2353

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Summary

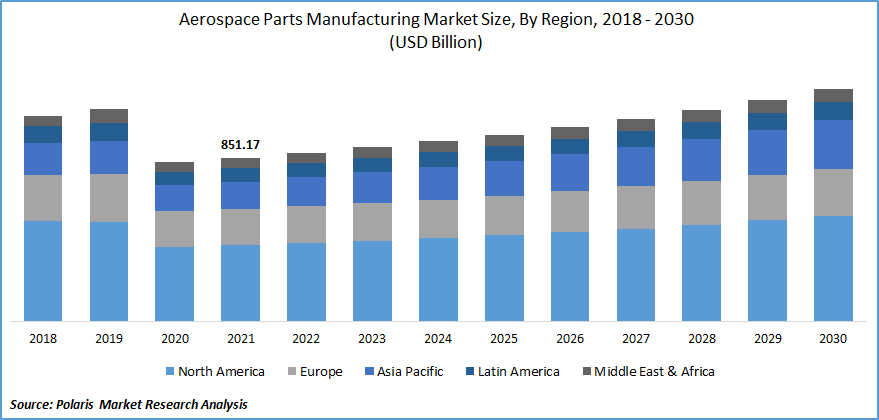

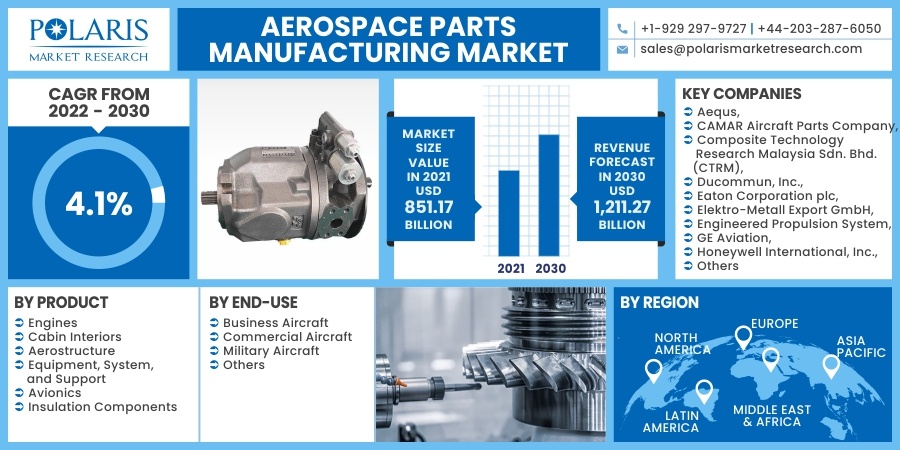

The global aerospace parts manufacturing market was valued at USD 851.17 billion in 2021 and is expected to grow at a CAGR of 4.1% during the forecast period. Increasing demand for lighter, innovative, as well as fuel-efficient airplanes in order to reduce carbon emission is expected to drive the market demand.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Moreover, increased fleet renewal levels contribute to a growth in aircraft manufacturing, which will likely drive the industry during the projected period. Moreover, numerous factors, such as technological advancements and the increased demand for airplanes suited for specialized tasks, will likely drive the worldwide aerospace parts manufacturing industry's expansion.

Industry Dynamics

Growth Drivers

The manufacturing industry benefited from a rise in collaboration actions for the advancement of aviation goods amongst leading competitors. For Instance, Kencoa Aerospace Corporation has teamed with SyncFab, the initial Manufacturing Blockchain® as well as Supply Chain Blockchain® platform between components manufacturers and purchasers, to provide digitalization ease and efficiency to customers in the aviation, aircraft, and military sectors.

Furthermore, leading manufacturers are moving their production activities to emerge nations to satisfy rising demand from MRO solution suppliers, which is influencing the aviation components factory industry. Moreover, airplanes' longer in-service duration gives industry participants lucrative prospects over the anticipated period. However, on the contrary, excessive capital expenditure and fluctuating raw material costs are projected to restrain the aerospace parts manufacturing market over the forecast period.

Know more about this report: request for sample pages

Report Segmentation

The market is primarily segmented based on product, end-use, and region.

|

By Product |

By End-Use |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Product

Aerostructure parts segment is expected to hold a major share of the aerospace parts manufacturing industry during the forecast period due to increasing the use of composite materials in the manufacturing of fuselages to reduce endurance upkeep in high-stress-loaded environments.

Furthermore, the introduction of innovative lighter aircraft constructions that improve efficiency is propelling worldwide manufacturing market development. The use of more lightweight components boosts the airplane's speed, reducing carbon pollution and improving fuel economy.

Insulation component segment is expected to grow at a significant pace over the forecast period due to the increasing airplane fleet as well as the periodic maintenance and replacement of aerospace parts. The avionics segment is expected to grow considerably over the forecast period due to aircraft upgrades with new technology, planned maintenance activities, coupled with increasing demand for fuel-saving technologies.

Insight by End-Use

Commercial aircraft segment is expected to dominate the global aerospace parts manufacturing market over the forecast due to increasing air traffic in emerging countries such as India and China. Furthermore, urbanization along with business & tourism travels are expected to propel the segment demand.

Military aircraft segment is expected to grow at a considerable pace over the forecast period due to increasing demand for fighter aircraft due to a surge in security concerns along with rising government initiatives to strengthen their military base.

Geographic Overview

North America dominated the market in 2021 and is expected to maintain its dominance over the forecast period due to the presence of critical manufacturers like GE Aviation, Intex Aerospace, and several others. Furthermore, rising requirements for innovative airplanes, along with increasing demand for fixed-wing aircraft, are likely to drive regional expansion in the aerospace parts industry over the estimated period.

Asia Pacific is expected to grow at a considerable pace over the forecast period due to increasing maintenance, repair, and overhaul (MRO) operations in the region's emerging economies. Furthermore, the increasing population along with the rising disposable income of consumers are expected to increase the demand for an airplane which in turn will boost the demand for the market.

Competitive Insight

Several players operating in the global aerospace parts manufacturing market include Aequs, CAMAR Aircraft Parts Company, Composite Technology Research Malaysia Sdn. Bhd. (CTRM), Ducommun, Inc., Eaton Corporation plc, Elektro-Metall Export GmbH, Engineered Propulsion System, GE Aviation, Honeywell International, Inc., IHI Corp., Intrex Aerospace, JAMCO Corp., Kawasaki Heavy Industries Ltd., Liebherr International AG, Lufthansa Technik AG, Mitsubishi Heavy Industries, Ltd., MTU Aero Engines AG, Raytheon Technologies Corp., Rolls Royce plc, Safran Group, Spirit AeroSystems, Inc., Subaru Corp., Superior Aviation Beijing, Textron, Inc., and Woodward Hexcel.

The market is highly competitive with the presence of numerous industry players. To compete in the marketplace and improve their client base, these firms spend in R&D to manufacture new unique goods and use marketing tactics such as product launches, mergers & acquisitions, cooperation & partnerships, and others. The Boeing Company, a significant stakeholder in the aircraft manufacturing sector, reached a deal in June 2019 to buy Encore Aerospace LLC, which manufactures cabin interiors as well as other components for the aviation industry.

Aerospace Parts Manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 851.17 billion |

|

Revenue forecast in 2030 |

USD 1,211.27 billion |

|

CAGR |

4.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Aequs, CAMAR Aircraft Parts Company, Composite Technology Research Malaysia Sdn. Bhd. (CTRM), Ducommun, Inc., Eaton Corporation plc, Elektro-Metall Export GmbH, Engineered Propulsion System, GE Aviation, Honeywell International, Inc., IHI Corp., Intrex Aerospace, JAMCO Corp., Kawasaki Heavy Industries Ltd., Liebherr International AG, Lufthansa Technik AG, Mitsubishi Heavy Industries, Ltd., MTU Aero Engines AG, Raytheon Technologies Corp., Rolls Royce plc, Safran Group, Spirit AeroSystems, Inc., Subaru Corp., Superior Aviation Beijing, Textron, Inc., and Woodward Hexcel. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Team Collaboration Software Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Pharmacovigilance Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Packaged Food Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Nitrous Oxide Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- On-board Charger Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030