Aerospace Fasteners Market Share, Size, Trends, Industry Analysis Report, By Material (Aluminum, Steel, Titanium, Superalloys); By Product; By Aircraft; By Application; By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 101

- Format: PDF

- Report ID: PM2001

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Summary

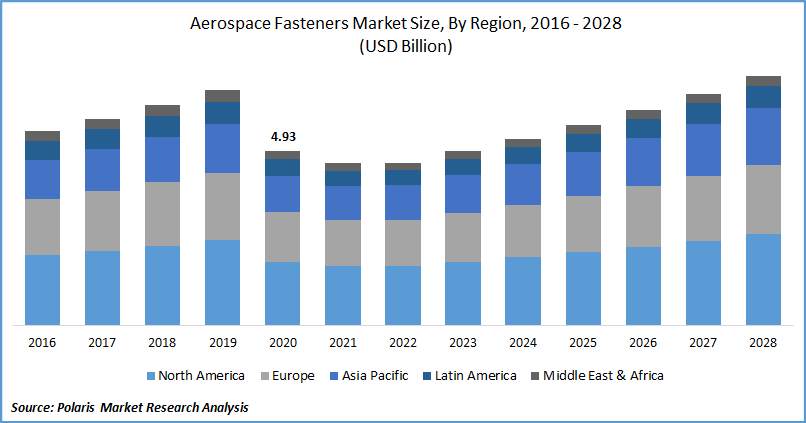

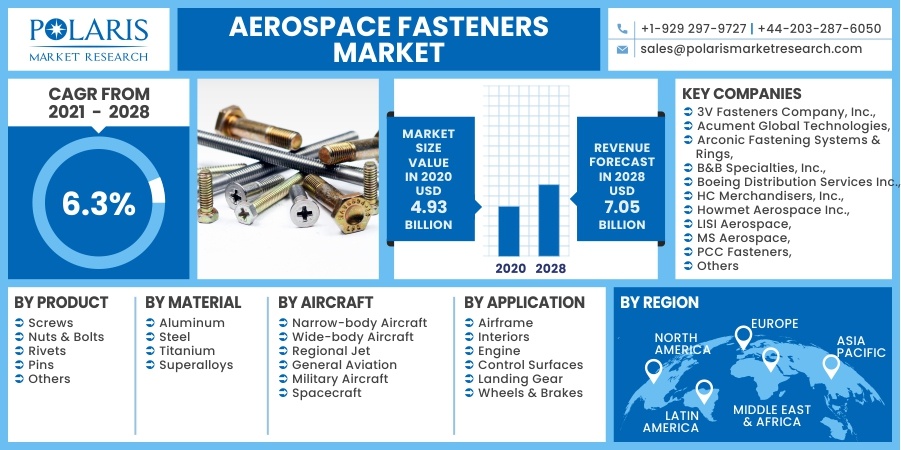

The global aerospace fasteners market was valued at USD 4.93 billion in 2020 and is expected to grow at a CAGR of 6.3% during the forecast period. Fasteners are the precision components utilized in aircraft to assemble different parts to form a complete structure. Although they are tiny and considered among small C-Class parts, they account for the highest part count in an aircraft; for instance, Boeing’s B747 aircraft has over six million parts, half of which are fasteners.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Aerospace Fasteners are designed not only to simply perform assembly functions but also to bear or transfer load from one part to another. They are subjected to extremely rigorous and strict standards for materials, processes, and quality assurance. Aerospace fasteners need to be certified by governments and OEMs such as FAA (Federal Aviation Administration), and Boeing and Airbus.

The COVID-19 pandemic has caused the aerospace fasteners market severe distress, and the year 2020 was full of uncertainty. The availability of raw materials and the overall supply chain of aerospace fastener has been severely hit with closed borders and lockdowns. Further, a hefty decline in aircraft orders and airlines deferment from receiving aircraft deliveries has caused disruption in the demand for aerospace fasteners as well.

However, the industry tends to recover at an impressive rate in the coming years and overall, there is an excellent growth opportunity for market players with stabilizing the aerospace fasteners market. Aggressive vaccination drives and resumption in air travel across the world are creating a healthy industry outlook in the coming years.

Industry Dynamics

Growth Drivers

Aircraft industry is constantly striving hard to overcome the challenge of reducing production lead time and enhancing faster assembly. Availability of efficient and mass volume of it can contribute towards timely part construction and assembly of systems or airframes. Besides, there is also increasing demand for lightweight and high-performance aerospace fasteners made of advanced materials with seamless installation fueling the ma across the globe.

The aerospace fasteners market has been experiencing an array of technological advancements, with 3D printing being a notable one. 3D printing enables the industry to produce plenty of them efficiently and effectively faster and with excellent part quality. There is also increasing demand for advanced coated component giving impetus to the aerospace market growth. The growing technological innovations are likely to surge the aerospace fasteners demand in the foreseen future.

Know more about this report: Request for sample pages

Report Segmentation

The market is segmented in the most comprehensive way based on product, material, aircraft, application, and region.

|

By Product |

By Material |

By Aircraft |

By Application |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Product

Nuts & bolts have been industry standard for assembly and joining of various structures, making them the most extensive product being certified and used in aircraft. They are extensively deployed in various application areas during assembly and MRO activities as they with-hold high tensile strength and can affix critical structural components together. Screws are the most widely used threaded component in an aircraft, making it a dominant segment in the aerospace market. Advancements in technologies and innovations have led to the emergence of lightweight yet high-performance screws in the market driving, the growth at an exponential rate. Titanium screws have been among the best candidates with excellent strength, significantly lower weight than steel counterparts, and high corrosion resistance.

Insight by Material

Aluminum alloy holds massive dominance in the market driven by its diversified usage across aluminum fuselage and wings. Best-selling aircraft platforms B737 and A320 including their variants, have aluminum airframes with aluminum-based aerospace fasteners deployed across surfaces. Superalloys have ability to withstand extreme stresses and temperature environments experienced by aerospace equipment and components. Some of the key factors giving impetus to the growth of superalloys include high strength, extreme temperature resistance, weight savings, high versatility, and resistance to corrosion and creep factors.

Insight by Aircraft

Narrow-body aircraft withstands the highest share of the global market driven by metallic airframe construction of best-selling narrow-body aircraft platform giving impetus of aerospace fasteners over adhesives. Increasing aircraft deliveries and a huge pile of narrow-body aircraft order backlogs further ensure healthy market opportunities. In 2020, Airbus was the largest OEM that managed to deliver 566 commercial aircraft, of which 446 alone were A320 family, and 38 were A220, both of which are key narrow -aircraft platforms across the world. The wide-body aircraft segment is more minor than narrow-body aircraft due to fewer deliveries.

However, there is a significantly high penetration of aerospace component in long-haul aircraft with wider bodies. For instance, two of the biggest aircraft platforms, B747 and A380 have more than six million parts and nearly half of which is just fasteners. The increasing share of next-generation wide-body aircraft platforms such as A350XWB and B787 having 50% content of composites is restraining the demand for aerospace fasteners as there is more usage of adhesives instead of fasteners.

Geographic Overview

Geographically, North America will lead the market driven by the strong leadership of the USA in both civil as well as defense aircraft. The region is hub for commercial aircraft production, business jet production, and fighter aircraft production along with its strong MRO capabilities driving the demand for aerospace component for both OEM and aftermarket. It has been continuously building up manufacturing capabilities, strengthening its leadership in the market. In May 2020, Airbus inaugurated its completed assembly line of A220 aircraft in Mobile, Alabama USA, which garnered an impressive 64 orders in 2020.

Asia Pacific region depicts the highest market growth driven by a rise in the number of aerospace component manufacturers in Asian countries The rise in the number of component manufacturers in India, China, and Southeast Asian Countries is giving an impetus to the demand for aerospace fasteners in the region. Further, significant investments also facilitate domestic manufacturing that has increased the demand in Asian market.

Competitive Landscape

The development of lightweight aerospace components with the ability to withstand highly corrosive environments and bear required stress is the prime strategy adopted by leading players to gain a competitive edge in the market. There has been a series of mergers & acquisitions in the market, increasing the consolidation level of the market gradually.

Some of the Key Players competing in the global market are 3V Fasteners Company, Inc., Acument Global Technologies, Arconic Fastening Systems & Rings, B&B Specialties, Inc., Boeing Distribution Services Inc., HC Merchandisers, Inc., Howmet Aerospace Inc., LISI Aerospace, MS Aerospace, National Aerospace Fasteners Corporation, PCC Fasteners, Stanley Black & Decker, Inc., Stanley Engineered Fastening, TFI Aerospace Corporation, TPS Aviation, Inc., TriMas Corporation, and Wurth Group.

Aerospace Fasteners Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 4.93 billion |

|

Revenue forecast in 2028 |

USD 7.05 billion |

|

CAGR |

6.3% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Product, By Material, By Aircraft, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

3V Fasteners Company, Inc., Acument Global Technologies, Arconic Fastening Systems & Rings, B&B Specialties, Inc., Boeing Distribution Services Inc., HC Merchandisers, Inc., Howmet Aerospace Inc., LISI Aerospace, MS Aerospace, National Aerospace Fasteners Corporation, PCC Fasteners, Stanley Black & Decker, Inc., Stanley Engineered Fastening, TFI Aerospace Corporation, TPS Aviation, Inc., TriMas Corporation, Wurth Group |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Agricultural Robots Market Research Report, Share and Forecast, 2018 – 2026

- Hospital Outsourcing Market Share, Size, Trends, Industry Analysis Report, 2020-2027

- Sugar-Free Chewing Gum Market Share, Size, Trends, Industry Analysis Report, 2023 - 2032

- Ambulatory Care Services Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Advanced Wound Care Management Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030