Adhesives and Sealants Market Share, Size, Trends, Industry Analysis Report, By Product Type (Acrylic, Silicone, Polyurethane, Polyvinyl Acetate); By Adhesion Technology; By End-Use; By Region; Segment Forecast, 2021 - 2028

- Published Date:Sep-2021

- Pages: 101

- Format: PDF

- Report ID: PM1164

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Summary

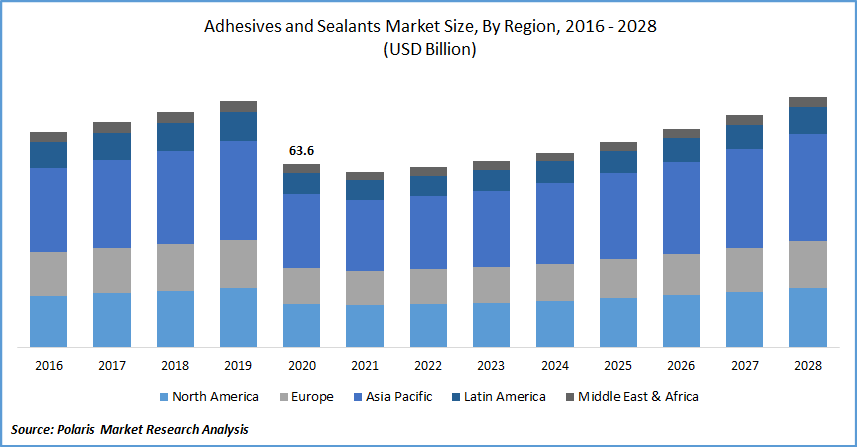

The global adhesives and sealants market was valued at USD 63.6 billion in 2020 and is expected to grow at a CAGR of 5.2% during the forecast period. Adhesives are used for permanent bonding and holding of surfaces such as metals, ceramics, glass, and plastics, among others. Sealants attach to two surfaces to provide a barrier or protective coating.

Sealants offer properties such as corrosion resistance and insolubility, which assist in filling gaps and voids. Adhesives and sealants are used in varied industries such as automotive, construction, packaging, industrial, marine, aerospace, and electronics, among others. There has been a high demand for adhesives and sealants from the automotive industry.

Know more about this report: request for sample pages

The COVID-19 outbreak has impacted the market owing to operational challenges, transportation delays, travel restrictions, disruption of the supply chain, and workforce impairment. The industry is experiencing a shortage of raw materials such as alcohol, photoinitiators, and dyes and pigments.

Whereas raw material like alcohol has been diverted for hand sanitizers and cleaning products, the supply of other raw materials has been restricted due to restrictions on the movement of goods from Europe, China, and India. Manufacturing activities have been halted due to various government regulations across the globe.

Some industries experiencing growth in demand for adhesives and sealants include medical devices and equipment, packaging, construction such as hospitals and quarantine centers, and home décor & DIY residential.

Some sectors that remain neutral in terms of growth during the pandemic include infrastructure projects and commercial construction. Industries that have been severely affected by the pandemic include industrial manufacturing, transportation, residential construction, oil & gas, and automotive, among others.

Industry Dynamics

Growth Drivers

These adhesives are used for a wide range of interior, exterior, and under the hood applications. The growth in the global automotive sector, increasing demand for modernized vehicles, and growing development of autonomous vehicles are expected to fuel the demand for the product in the future.

The global adhesives and sealants market is fueled by the economic growth in countries such as China, Japan, and India, rising industrialization, and growing penetration of automobiles in Asia-Pacific. Global players are expanding into these countries to tap the market potential of the electronics industry.

Technological advancements and established R&D institutes in China and Japan further contribute to the growth. There have been new product launches and acquisitions by leading players in the market coupled with technological advancements.

Growing disposable income, changing lifestyles, increasing investment in the construction industry, and public infrastructure development would support the market growth. Increasing awareness associated with green and sustainable buildings is expected to offer market growth opportunities during the forecast period.

The growth in market demand from the healthcare sector has increased significantly owing to growing investments in research and developments and medical advancements. The rise in demand for technologically advanced medical equipment, growing healthcare expenditure, and increasing need to offer enhanced medical services to patients have increased the applications of adhesives and sealants.

Adhesives and Sealants Market Report Scope

The market is primarily segmented on the basis of product, adhesive technology, end-use, and region.

|

By Product |

By Adhesion Technology |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Product

The product segment has been divided into acrylic, silicone, polyurethane, polyvinyl acetate, and others. The market demand for polyurethane is expected to increase during the forecast period. Polyurethane adhesives and sealants are used in diverse industries owing to their high performance in challenging environments.

These adhesives and sealants work with porous and nonporous materials such as paper, leather, metals, concrete, plastics, wood, rubber, epoxy, and glass. These adhesives and sealants are usually waterproof, weatherproof, and capable of operating under a wide temperature range. Some applications of polyurethane adhesives and sealants include footwear, textile laminates, automotive interiors, among others.

Insight by Adhesion Technology

The adhesive technology segment has been divided into solvent-based, water-based, reactive, hot melt, and others. Water-based technology accounted for a significant share in the global market in 2020. These adhesives and sealants are increasingly being used owing to growing environmental concerns and the rising trend of green technology. Low volatile organic compounds in water-based adhesives and sealants, reduced weight, and greater performance have increased market demand over the forecast period.

Insight by End-Use

On the basis of end-use, the market is segmented into automotive, construction, packaging, healthcare, electrical and electronics, consumer, and others. The construction segment dominated the global adhesives and sealants market. In the construction sector, adhesives and sealants find a wide range of applications in flooring, walls and roofs, and outdoor applications.

Adhesives and sealants provide strong bonds to concrete and wood, metal, glass, stone while offering high heat- and chemical resistance. They provide high strength, solubility, flexibility, appearance permanence, and corrosion resistance, among others. Growth in the construction sector and the development of public infrastructure are expected to provide growth opportunities.

Geographic Overview

The Asia Pacific dominated the global adhesives and sealants market in 2020. Increasing urbanization, growing research and development activities, expansion of international players in this region, and technological advancements are some factors attributed to the growth of this region.

The industrial growth in countries such as China, India, and Japan, rising automotive penetration, and increasing construction and development activities boost the growth of this region. Increasing applications in the electronics, healthcare and footwear sectors have further increased the region's demand for adhesives and sealants.

Competitive Landscape

The leading players in the adhesives and sealants market include Arkema S.A., Artimelt AG, Avery Dennison Corporation, H.B. Fuller Company, 3M Company, Ashland Global Specialty Chemicals Inc., AdCo (UK) Ltd, Henkel AG, Beardow Adams, Huntsman Corporation, Dow Inc., Sika AG, Illinois Tool Works Inc., Wacker Chemie AG, and Hexcel Corporation.

These players are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their presence in the market. The companies are also introducing new innovative products in the market to cater to the growing consumer demands.

Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 63.6 billion |

|

Revenue forecast in 2028 |

USD 85.4 billion |

|

CAGR |

5.2% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Product, By Adhesion Technology, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Arkema S.A., Artimelt AG, Avery Dennison Corporation, H.B. Fuller Company, 3M Company, Ashland Global Specialty Chemicals Inc., AdCo (UK) Ltd, Henkel AG, Beardow Adams, Huntsman Corporation, Dow Inc., Sika AG, Illinois Tool Works Inc., Wacker Chemie AG, and Hexcel Corporation. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Aircraft Cabin Interior Composites Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Gout Therapeutics Market Research Report, Size, Share & Forecast, 2022 - 2029

- Data Center Liquid Cooling Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Cryptocurrency Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Compressed Natural Gas (CNG) Market Share, Size, Trends, Industry Analysis Report, 2020-2027