5G Enterprise Market Share, Size, Trends, Industry Analysis Report, By Access Equipment Type (Radio Node, Service Node, DAS); By Core Network Technology (SDN, NFV); By Service (Platform, Software); By Organization Size (SMEs, Large Enterprises); By End-Use; By Region; Segment Forecast, 2021 - 2029

- Published Date:Nov-2021

- Pages: 101

- Format: PDF

- Report ID: PM1704

- Base Year: 2020

- Historical Data: 2020

Report Summary

The global 5G enterprise market was valued at USD 2.04 billion in 2020 and is expected to grow at a CAGR of 37.6% during the forecast period. The introduction of Industry 4.0, the growth of intelligent infrastructure, and the supply of specialized 5G services via network slicing technologies are propelling the worldwide 5G enterprise market.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry 4.0 is a significant growth factor for the market because it enables organizations to handle vast quantities of information, which improves efficiency and productivity by using innovative technologies such as artificial intelligence, robotics, connected sensors, and cloud services.

The COVID-19 pandemic has favorably influenced the expansion of the market. To ease business operations throughout the COVID-19 pandemic, authorities from numerous emerging countries and private enterprises are collaborating to accelerate the advancement of the 5G enterprise and networks. Furthermore, digital transformation of enterprises and Work from home (WFH) methods have emerged as critical components in creating 5G enterprise.

Furthermore, the pandemic has influenced both 5G preparation and deployments, as some nations have postponed their 5G spectrum bidding equipment contracts as well as other preparedness activities, while others have implemented laws linked to prioritizing 5G expenditure which in turn is anticipated to generate the substantial potential for the worldwide 5G enterprise market. Nevertheless, owing to a restricted supply of auxiliary devices, including optical fiber wire & micro stations throughout lockdown, the installation of 5G enterprise is significantly hampered.

Industry Dynamics

Growth Drivers

Aspects including the 5G enterprise interconnection stage, which is expected to motivate different industries with a single system, the unified 5G enterprise connection, which is expected to progress cross-market linkage and industrial function development, and the increasing presence of software applications in the data transmission are expected to drive the expansion of the 5G enterprises market during the forecast period.

For example, in February 2021, Huawei and China Mobile will launch the world's first commercialized 4.9 GHz LampSite system in Shanghai, China. It's the first time that an average frequency of 200 MHz on both 2.6 and 4.9 GHz frequency bands and dispersed Massive MIMO has been deployed in digital interior systems at the same time.

Furthermore, the surge in demand for next-generation telecommunications network services among businesses promotes the enterprise market's expansion. Additionally, the growing need for engaging, fast, and premium communication and information services and new technologies like the IoT and artificial intelligence are projected to present attractive prospects for market development throughout the projection period. For instance, on April 15, 2021, Nokia stated that it had conducted a mmWave technology testing on Mobily's live 5G business networks in Riyadh.

Challenges

The expansion of Wi-Fi wireless communication as the contra connection technology amongst other organizations and the lack of authority in preserving and operating a company's network is the primary issues most expected to stymie the development of the 5G enterprises market during the forecast period.

Report Segmentation

The market is primarily segmented on the basis of Access Equipment, By Core Network Technology, By Services, By Organization Size, By End-Use, and by geographic region.

|

By Access Equipment |

By Core Network Technology |

By Services |

By Organization Size |

By End-Use |

By Region |

|

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Access Equipment

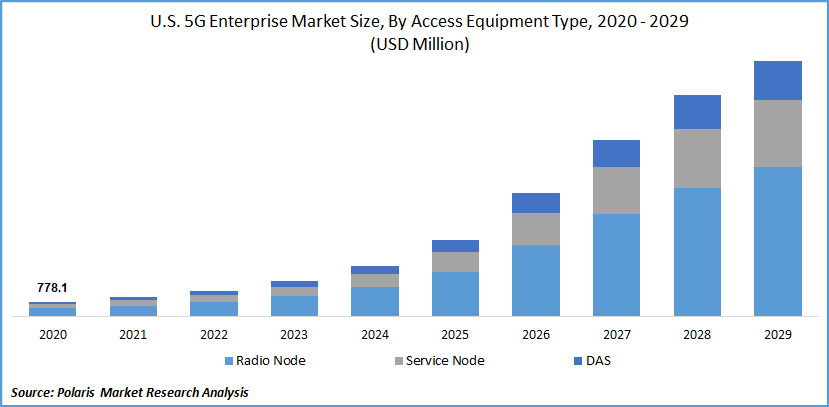

In 2020, the radio node market segment accounted for the highest share of 57.3% in 2020 and is expected to maintain its dominance over the forecast period. This high market share is attributed to its large deployments by large-scale organizations and telecom operators.

The market growth is also favored due to its benefits, such as providing the complete network with reduced maintenance and operational costs, separate hardware flexibility, the ability to complement the current cloud-based technologies, and low barriers to cross-domain innovation.

Insight by End-Use

In 2020, the manufacturing market segment accounted for a majority revenue share of 23.2% and is expected to witness the fastest growth, with prominent manufacturers like Gabler already adopting AR and VR technology in training operations and repair and maintenance. A 5G network can quickly provide a bandwidth demand of 100 Mbps for a seamless AR/VR encounter.

Geographic Overview

During the projection period, the North American market is anticipated to expand at a CAGR of 37.9%. The rising need for sophisticated technologies such as machine-to-machine connectivity, artificial intelligence, and linked automobiles, amongst others, is propelling regional enterprise market expansion.

Furthermore, although large carriers such as Verizon and AT&T are promoting the 5G story on a corporate level, other operators, including Sprint and T-Mobile, attempted to strike a balance in which their separate networks are promoted equally to companies and consumers.

Due to significant installations of 5G networks by mobile carrier providers including ZTE, Huawei, and Ericsson, the Asia Pacific area has the most potential for development throughout the anticipated period. As per a November Ericsson connectivity analysis, India would have 350 million 5G subscribers by 2026, accounting for roughly 27% of overall wireless subscriptions.

Competitive Insight

Some of the major players operating the global market include Affirmed Networks, Airspan Networks, American Tower, AT&T Inc., China Mobile, Ciena Corporation, Cisco Systems Inc., Comba Telecom Systems, Commscope, EE Limited (BT Group), Ericsson, Extreme Networks, Fujitsu, Hewlett Packard Enterprise, Huawei Technologies Co., Juniper Networks, Korea Telecom, Mavenir, NEC, Nokia, Qualcomm Technologies Inc., Samsung, SK Telecom Co. Ltd., T-Mobile, Verizon Communications, VMware, Inc., ZTE Corporation among others.

The critical market focused on emphasizing their share and product portfolio in 5G enterprises by adopting strategies such as new product releases, expansions, agreements, joint ventures, partnerships, collaboration, and Mergers & Acquisitions (M&A) to enhance their footprints in the enterprise market for long term.

For instance, China Mobile, Haier, and Huawei will reveal their 5G MEC Joint Development Base at the Haier Institute of Industrial Intelligence in February 2021. 5G is an excellent alternative for constructing secure connections for businesses. Its full potential is realized when combined with MEC, a strong facilitator for a combination of connection, processing, and applications.

5G Enterprise Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 2.04 billion |

|

Revenue forecast in 2029 |

USD 33.68 billion |

|

CAGR |

37.6% from 2021 - 2029 |

|

Base year |

2020 |

|

Forecast period |

2021 - 2029 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2029 |

|

Segments covered |

By Access Equipment, By Core Network Technology, By Services, By Organization Size, By End-Use, and, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Affirmed Networks, Airspan Networks, American Tower, AT&T Inc., China Mobile, Ciena Corporation, Cisco Systems Inc., Comba Telecom Systems, Commscope, EE Limited (BT Group), Ericsson, Extreme Networks, Fujitsu, Hewlett Packard Enterprise, Huawei Technologies Co., Juniper Networks, Korea Telecom, Mavenir, NEC, Nokia, Qualcomm Technologies Inc., Samsung, SK Telecom Co. Ltd., T-Mobile, Verizon Communications, VMware, Inc., ZTE Corporation among others. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Soft Tissue Sarcoma Treatment Market Research Report, Size, Share & Forecast by 2014 - 2025

- Automotive Interior Materials Market Research Report, Size, Share & Forecast by 2018 - 2026

- Ultrasound Devices Market Research Report, Size, Share & Forecast by 2017 - 2026

- Fatty Acid Methyl Ester (FAME) Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Food Safety Testing Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028